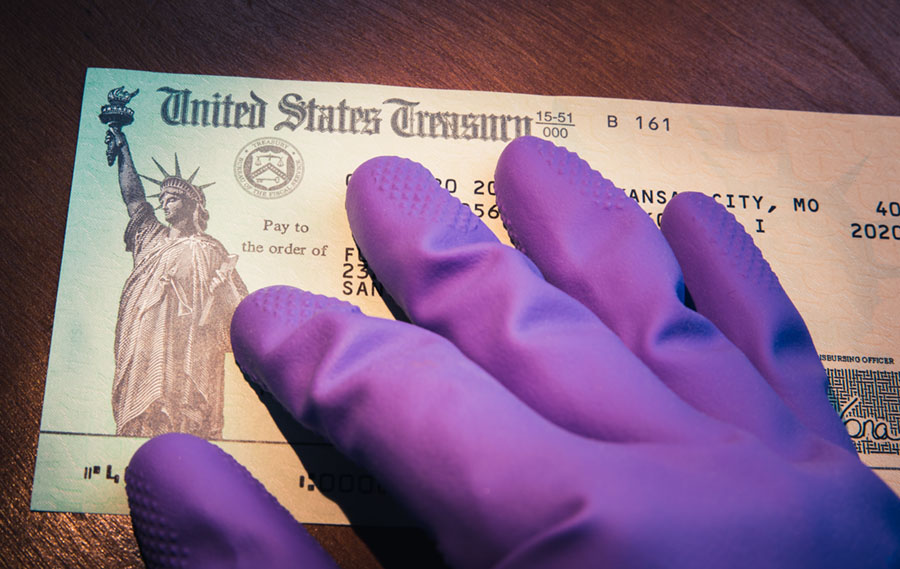

The 700 Billion Bailout is Taxpayer Burden

The 700 Billion Bailout Condones Corruption. The Fed is Accountable to no One. It Seems the U.S. Government is Rewarding Corporate Executives for Failure.

The 700 billion bailout was the result of a hurried piece of legislation passed at the end of 2008 as a means to combat the credit crisis and turn around the United States (and in turn, global) economy.

Is Congress reward corporate America for failure?

The bailout was authorized in the Emergency Economic Stabilization Act of 2008 to rescue the failing U.S. financial system and restore faith in credit markets.

the majority of Americans were against it, the U.S. Government justified the unfathomably enormous spending as ”necessary” in order to prevent total and utter collapse of the financial market at home and abroad.

In other words, just like with the Patriot Act and the great global warming hoax, they once again used fear as a tactic to hurriedly pass extreme legislation at the expense of the American people.

The country had been in a recession for years, but the government refused to admit it and the mass media refused to report on it. The 700 billion bailout was swept under the rug.

The credit crisis did not suddenly fall upon us out of the blue; it was a continually mounting crisis based on the faulty economic system in which both corporations and individuals relied on credit (rather than savings) to survive.

This system kept businesses and people in perpetual debt, dependent on credit – upon which the controlling elite reaped their profits.

Perpetuates the Problem

It’s clear that the government, economists, and bankers have no idea what they are doing. As Einstein said,

”We can’t solve problems by using the same kind of thinking we used when we created them.”

Awarding Wall Street with a 700 billion bailout to perpetuate their corrupt business practices is counter-intuitive.

Simply flinging money at the problem isn’t going to make it go away; it will only perpetuate the bad policies and practices that brought on the financial turmoil in the first place.

The 700 billion bailout doesn’t solve anything; it simply feeds the problem. For starters, the $700 billion dollars was created out of thin air by the Federal Reserve, which causes inflation.

It is an unsustainable system of fiat money, and it’s only a matter of time before it collapses.

Instead of considering other alternatives, the government chose to feebly prop up a failed system.

The $700 billion dollars is only a drop in the bucket amidst the nation’s financial troubles.

How much more is the government willing to spend before admitting that this wasteful spending is accomplishing nothing?

Condones Corruption

After AIG was committed $85 billion, over 1/10 of the total bailout package; they threw themselves a lavish party at a posh ocean-side resort in California, to the tune of nearly half a million dollars.

To top it all off, several months later they announced that they will distribute bonuses as usual.

This news wasn’t at all funny to AIG shareholders who lost their life savings when AIG collapsed.

It is clear that the bailouts are funding the lifestyles of the corporate fat cats without requiring accountability. In the real world, if you screw up, you go bankrupt.

Thus you are forced to start over and you learn from your mistakes. It’s a humbling process, one that brings people down to earth.

As long as our government bails out Wall Street, there will be no accountability.

$700 Billion Bailout: The People who Really Need it

The bailout plan does nothing but prop up a deteriorating financial system at the expense of the people.

They claim that the $700 billion bailout is necessary to prop up the economy, and that it’s needed to save not just Wall Street, but more importantly to save ”Main Street”.

If they really wanted to save Main Street, why not bail out struggling home owners, small businesses and individuals?

The common people are never so lucky; therefore, we need to learn to live within our means and continue demanding accountability and reform.

My First Amazing Ayahuasca Experience

My First Amazing Ayahuasca Experience  Pine Needle Tea

Pine Needle Tea  The REAL Controllers of Humanity: The Papal Bloodlines

The REAL Controllers of Humanity: The Papal Bloodlines  Is it Global Warming or Cooling?

Is it Global Warming or Cooling?  Gun Rights and Obama Examined

Gun Rights and Obama Examined